Externalities are the effect on the third party of an action

made by an individual or a firm - whether it be for the better or the worse. A

lot of the time externalities are negative, pollution for example, and this is

the example we will use here. We'll look at a firm in industry creating a good

that means they are polluting the atmosphere.

With externalities being ignored, the firm will hire workers

and capital according to the rule: (Marginal revenue product of labour =

marginal cost of labour = wage = marginal cost of labour)

In Layman's terms, this means they'll employ labour up until

the point where the marginal revenue product of labour is equal to the marginal

cost of labour, meaning profits are being maximised. If the producer had to

clean up the pollution as well then the amount they'd employ would become:

What has been added is a new Price, the price of cleaning

pollution. This is taken away from the price of the product they're producing

which will overall leave a lower figure. If we rearranged above we could

achieve this:

The marginal cost of the good will now be the wage plus the

marginal cost of cleaning up the pollution. This means the social cost of the

firms actions have been taken into account. Previously, the marginal cost of

production was below the marginal social cost - leading to an overproduction.

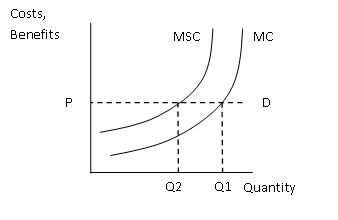

Here it is graphically:

Q2 is the social optimum when the cost of clearing the pollution is taken into account. If MSC is greater than MC then there are external costs of production, if it's the other way round there are external benefits to production.

Now for a quick look at public goods, a fairly simple

sub-topic. A public good is one that has the characteristics 'non rival' and 'non

excludable'. What does this mean? It means that my consumption of the good does

not stop other people consuming it (non rival) and I cannot be prevented from

consuming the good once it is provided (non excludable). Street lighting is a

good example. It's a good that generally has to be provided by a government

because no individual or firm would pay for it - they'd just wait for someone

else to buy and free ride. A good that has only one of the characteristics

stated above but not both is known as a 'quasi-public good'.

That's all boys and girls! Comment if you need more help,

share the blog if it has assisted you. Cheers!

Sam.

Sam.

No comments:

Post a Comment